Loan lump sum payment calculator

Use this calculator to compare the numbers and determine how much you can. Mortgage Calculator zip file - download the zip file extract it and install it on your computer.

Loan Calculator

The amount of money you have to invest now in order to reach your lump sum goal in time.

. How to use Home Loan Prepayment Calculator. Your monthly payment is about 2100. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest.

The borrowers can also determine the overall saving that can be done with the help of the SBI home loan prepayment calculator. Present Value Discount Rate. Calculate the monthly payments total interest and the amount of the balloon payment for a simple loan using this Excel spreadsheet template.

Then there are two ways to calculate your loan using the loan. If you choose to pay down your mortgage you will have opportunity costs the value of what your money could have done if you hadnt used it. First enter a principal amount for the loan and its interest rate.

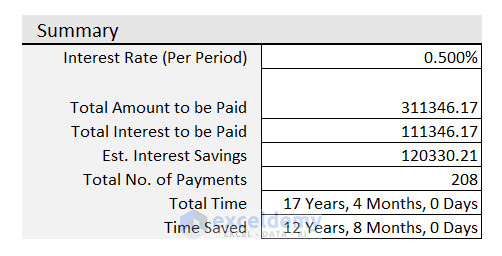

Then input the loan term in years and the number of payments made per year. This calculator can help you compute your loans monthly biweekly or weekly payment and total interest charges. In addition to saving interest payment youll also repay the loan sooner freeing up extra cash at the end.

We have an article discussing the differences between nominal rates effective rates and APR. 20 years 6 months. Even if you plan on rolling over your pension payout some companies withhold.

To determine the amount of time it will take to fully repay your loan given a certain monthly payment Loan APR interest rate. The main download and the Google version now have. Assume you buy a home and take out a 30-year 500000 loan at 3 interest.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. Investors can avoid taxes on a lump sum pension payout by rolling over the proceeds into an individual retirement account IRA or other eligible retirement accounts. Making a lump-sum mortgage payment isnt your only option if youre fortunate enough to have extra money.

Unlike fixed-rate mortgages ARM loans will reset at a predetermined length of time depending on the loan program. This home loan prepayment calculator gave me the inspiration to become debt free. Loan Payment Calculator.

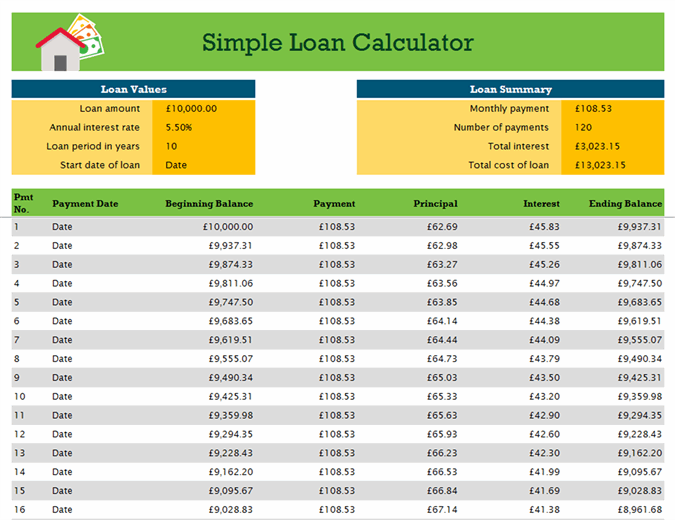

Enter it as a percentage value ie. The spreadsheet includes an amortization and payment schedule suitable for car loans business loans and mortgage loans. Here are two things you need to know.

With each subsequent payment you pay more toward your balance. An auto loan early payment calculator helps you save money by making extra monthly payments. Home loan repayment calculator.

The loan amount the interest rate and the term of the loan can have a dramatic effect on the total amount you will eventually pay on a loan. Enter the dollar amount as the future lump sum. The part payment amount should at least be three times the monthly EMI.

I wanted a to know if giving more money as EMI beneficial or giving lump sum amount as pre payment of home loan plan. To figure out how much youll need to pay each month to finish repaying your loan in a certain amount of time. A balloon payment is a large lump-sum payment made at the end of a long-term loan.

Use our home loan calculator to estimate what your monthly mortgage repayments could be. The above example shows the monthly and annual savings you will enjoy with a lump sum payment. The borrower should preferably have lump-sum access funds for initiating a home loan part payment.

Use the interest rate at which the present amount will grow. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. What is a balloon payment.

Use our loan payment calculator to determine the payment and see the impact of these variables on a specified loan amount complete with an amortization schedule. If youve received a lump-sum payment from an inheritance tax refund or commission from a sale youre probably considering how to best use the money. You then get a report on how much you save in terms of money and time on the loan.

11 instead of 11. Loan Original Payment Lump-Sum Payment. This is the best option if you plan on using the calculator many times over the.

Heres an example. There are two ways to implement the loan payoff calculator. It works when you supply details of the loan term loan amount additional monthly payment intended current payment and interest rates.

Once the loan term is up youve paid for the car plus interest. Whether youre refinancing or just wanting to understand how much you can afford all you have to do is enter how the amount you would like to borrow interest rate home loan term payment frequency and repayment type either principal. Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI.

This financial planning calculator will figure a loans regular monthly biweekly or weekly payment and total interest paid over the duration of the loan. With this information in mind you can better evaluate your options. Monthly interest savings lump sum rate frequency.

Interest is what the auto loan company charges you to borrow the money. How to Avoid Taxes on a Lump Sum Pension Payout. Paying down more principal increases the amount of equity and saves on interest before the reset period.

Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculatorWhen you pay extra on your principal balance you reduce the amount of your loan and save money on interest. This loan calculator compounds interest on a monthly basis the compound interest calculator has multiple options for compounding. 60000 one-time payment Monthly Payment PI Pay-off Time.

Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. This also increases the chances of refinancing out of a variable rate loan as the equity in the home rises. You get a lump sum upfront.

Instead of borrowing a lump sum a line of credit allows you to borrow as much or little as you need up to your credit limit. Present Value of Money. In five years you have extra cash and decide to put 100000.

The car loan company pays the dealer a lump sum for the car and they technically own it while you repay the loan over several years. Now after years of painstaking focus and persistence I am finally debt free. For exmample if you had access to 10000 and could apply the sum immidiately to a 3 loan then you can calculate how much you will save in interest monthly with the following equation.

And please explain it in similar way. The monthly payment on a 10000 loan usually costs between around 184 to 590 depending on the loan term and interest rate. If you are making both recurring payments AND a one-time payment you can enter both in the calculator below though make sure you select the correct dates for each.

Full usage instructions are in the tips tab below. Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years. This personal loan calculator gives you three numbers.

This is the best option if you are in a rush andor only plan on using the calculator today.

Extra Payment Calculator Is It The Right Thing To Do

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

The Mortgage Payment Calculator Helps You Determine How Much Interest You Save Or How Much Of A Mortgage Mortgage Payment Mortgage Payment Calculator Mortgage

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Pay Off Mortgage Early Mortgage Payment Calculator

Auto Loan Calculator Free Auto Loan Payment Calculator For Excel

Advanced Loan Calculator

Accelerated Debt Payoff Calculator Mls Mortgage Amortization Schedule Debt Payoff Mortgage Calculator

Pin On Mortgage Calculator Tools

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Loan Payoff Debt Calculator Student Loans

Mortgage With Extra Payments Calculator

Extra Payment Mortgage Calculator For Excel

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Mortgage Calculator With Extra Payments And Lump Sum Excel Template In 2022 Mortgage Loan Calculator Excel Templates Mortgage

Loan Repayment Calculator

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment